How DeFi Lending Protocols Work

DeFi lending protocols let you earn yield by supplying crypto to liquidity pools. Borrowers pay interest to use those funds – smart contracts enforce the rules, no banks involved.

With $56B+ locked across lending protocols (per DeFiLlama), DeFi lending has proven product-market fit. That scale means deep liquidity – you can deposit and withdraw substantial amounts without slippage.

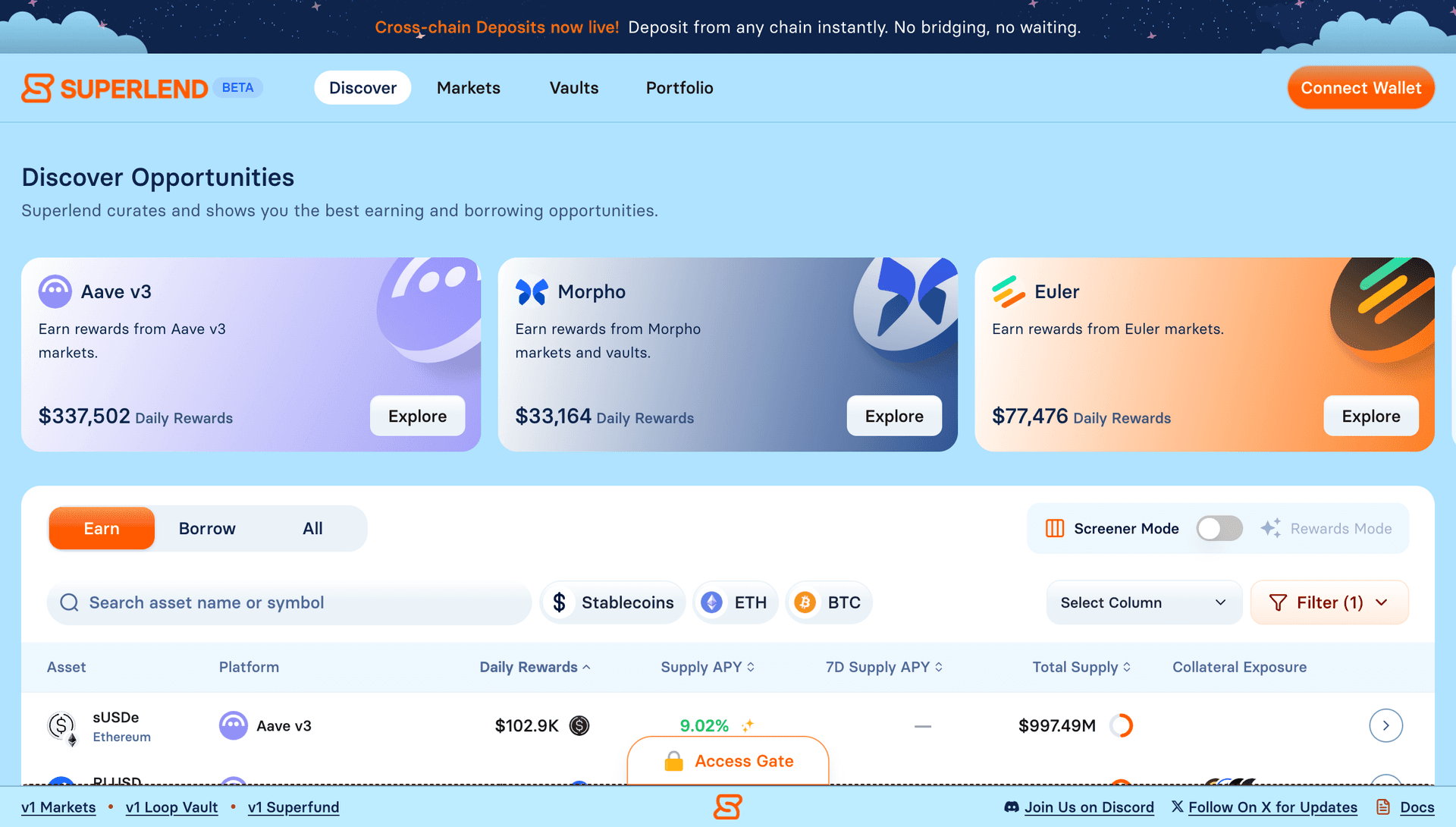

Superlend is a non-custodial aggregator connecting you to 350+ money markets across 11+ chains. Compare rates across Aave, Compound, Morpho, and more from one dashboard – then execute directly. This guide covers which assets to lend, how rates work, and what risks to manage. For a comprehensive introduction, see our complete guide to DeFi lending.

What Assets Are Available on DeFi Lending Protocols?

Most lending protocols support a range of crypto assets. The most common categories are:

Stablecoins (USDC, DAI, USDT)

These are popular for lenders who want steady returns without the volatility of regular crypto. Stablecoins are designed to maintain a value pegged to a real-world currency (usually the US dollar). This means when you lend stablecoins, you're less exposed to big price swings and your $1 stays close to $1. For a deep dive into stablecoin opportunities, see our stablecoin yield strategies guide.

That's why many people use stablecoins as a way to earn passive income on idle funds. Instead of just holding them in a wallet, you can supply them to a lending pool and earn interest – often higher than traditional savings accounts, while keeping your principal relatively stable.

Major Tokens (ETH, BTC)

Many borrowers use these as collateral or borrow them to take leveraged positions. For example, someone might deposit ETH as collateral and borrow stablecoins to trade or invest elsewhere, without selling their ETH. Others borrow ETH or BTC directly to amplify their exposure.

Lending these major tokens can earn you higher yields compared to stablecoins, but remember: their prices can be volatile, which can affect the health of borrowers' positions and liquidity in the pool.

Long-Tail or Niche Tokens

Some platforms list smaller or newer tokens that aren't as widely traded. These can offer higher yields to attract lenders, but they're riskier and often less liquid.

Because fewer people supply and borrow these tokens, it can be harder to withdraw your funds quickly, and price swings can be extreme. If you're considering lending niche tokens, understand the project behind the token and the market demand.

When you supply an asset to DeFi lending protocols, you're adding it to a shared pool (the liquidity pool). Other users can then borrow from that pool. In return, you earn interest.

How Do DeFi Lending Protocols Set Interest Rates?

Unlike traditional banks that fix rates behind closed doors, DeFi lending rates are dynamic. They're usually based on supply and demand for each asset.

Here's how it works:

- When many people lend an asset but few are borrowing, the interest rates tend to drop

- When more people want to borrow, rates go up to attract more liquidity from lenders

- Most protocols use an Interest Rate Model (IRM) to adjust rates automatically

Some advanced DeFi lending protocols even have variable models that adapt more smoothly to large inflows or outflows. This helps keep things balanced and ensures there's always enough liquidity for borrowers and lenders alike.

What Are the Main Risks of DeFi Lending Protocols?

Lending in DeFi can be rewarding, but it's not risk-free. Here are the main things to watch out for:

Smart Contract Risk

Bugs or exploits in the code can lead to losses. Always use protocols that have been audited by reputable security firms.

Liquidity Risk

If too many users withdraw at once or borrowers can't repay, you might not be able to pull out your funds instantly.

Volatility Risk

If you lend volatile tokens instead of stablecoins, price swings can affect your position and the overall pool health.

Protocol Risk

Some newer or smaller protocols might not be as battle-tested as established names like Aave, Compound, or Morpho.

Always do your research, and consider using protocols that have been audited and used by many people over time.

How Superlend Simplifies DeFi Lending Protocols

At Superlend, we help users access deep liquidity and optimized rates across multiple DeFi lending protocols – with tools to manage risks more easily.

Why use Superlend:

- Access 350+ money markets from one dashboard

- Compare rates across Aave, Morpho, Compound, and more

- Find the best opportunities without switching between protocols

If you're ready to put your stablecoins to work or want to explore different strategies, check out lending opportunities across 350+ money markets and vaults.

Explore Superlend Markets | Access SuperFund in the Vaults Section

Frequently Asked Questions

What is a DeFi lending protocol?

A DeFi lending protocol is a decentralized platform that allows users to lend and borrow crypto assets without intermediaries. Smart contracts automate the process, matching lenders with borrowers and managing collateral requirements.

How do I earn from DeFi lending protocols?

You earn by supplying assets to a lending pool. Borrowers pay interest on their loans, and that interest is distributed to lenders proportionally based on their deposits.

Which DeFi lending protocols are safest?

Established protocols like Aave, Compound, and Morpho have been audited multiple times and have billions in TVL. However, no protocol is completely risk-free. Diversifying across protocols and using aggregators like Superlend can help manage risk. Learn more in our guide on whether DeFi lending is safe.

Start Lending on DeFi Protocols Today

Ready to make your idle crypto work for you? Explore DeFi lending protocols through Superlend's unified dashboard.

Browse 350+ Markets | Explore Vaults (SuperFund & Loop)

This article is for educational purposes only and does not constitute financial advice. DeFi involves risks including smart contract vulnerabilities and market volatility. Rates are variable and subject to change. Past performance does not guarantee future results. Always do your own research.