DeFi Yield Optimization: Understanding Yield Ramp-Up

Yield Ramp-Up smooths your returns over 7-14 days instead of paying instantly. This protects against rate volatility and whale manipulation – your APY becomes more predictable.

Most yield protocols distribute earnings immediately, which creates problems: sudden rate dips when whales deposit, spikes when they withdraw, and inconsistent returns that make financial planning difficult. Yield Ramp-Up fixes this by buffering earnings and releasing them gradually.

The Volatility Problem in DeFi Yield Optimization

Many yield platforms operate on a near-instantaneous distribution model. When a protocol generates yield from lending, trading fees, or other mechanisms, that yield is often paid out to depositors almost immediately. While seemingly efficient, this approach carries several drawbacks:

Sudden Rate Dips and Spikes

Yields in DeFi are dynamic, influenced by market demand for borrowing, liquidity depth, and overall market sentiment. Instantaneous payouts mean users are immediately exposed to these fluctuations. A sudden influx of capital into a lending pool can drastically dilute the APY for existing users, while a rapid withdrawal can cause an equally sharp spike.

"Whale" Impact and Manipulation

The instantaneous nature of yield distribution can create opportunities for large depositors ("whales") to disproportionately influence rates. A whale depositing massive capital can quickly dilute the APY for everyone else. By strategically withdrawing or depositing, they can create artificial rate swings that smaller participants find difficult to navigate.

Uneven User Experience

For users seeking consistent passive income, unpredictable yield can be frustrating. It makes financial planning difficult and can erode trust in the platform's ability to deliver stable returns.

Hence most regular folks prefer fixed rate lending protocols. For a broader understanding of how DeFi lending works, see our complete guide to DeFi lending. For DeFi risk management, check our guide on whether DeFi lending is safe.

Common DeFi Yield Distribution Models

Some distribution models used by DeFi protocols include:

1. Real-Time Distribution (Instantaneous)

This is the most common model, where earned yield is added to a user's balance almost as soon as it's generated. While transparent, it's highly susceptible to the volatility described above. Lending markets on protocols like Aave or Morpho demonstrate how borrowing demand and liquidity supply directly impact real-time APY.

2. Epoch-Based Distribution

Some protocols distribute yield at fixed intervals – daily, weekly, or monthly epochs. This provides a slightly more predictable schedule than real-time, but the underlying volatility of earned yield within that epoch can still lead to significant fluctuations.

3. Token Incentivized Distribution (Yield Farming)

Many platforms use their native tokens to incentivize liquidity provision. While these token rewards can significantly boost overall APY, their value is often highly volatile.

How Yield Ramp-Up Improves DeFi Yield Optimization

Now, let's discuss a better approach: Yield Ramp-Up – a not-so-new but efficient mechanism that introduces a buffered approach to yield distribution. Instead of paying out earned yield all at once, it's gradually distributed over a predetermined period, typically 7-14 days.

This mechanism offers several significant advantages for DeFi yield optimization:

1. Smooth, Stable Return Curve

By spreading out the yield distribution, the impact of market fluctuations is mitigated. If there's a temporary dip in underlying rates, the stored yield acts as a buffer, ensuring users continue to receive consistent payouts. This creates a much more predictable and less "jittery" return curve – ideal for long-term savers.

2. Protection Against Rate Dips and Spikes

The gradual release mechanism acts as a shock absorber. It averages out the yield earned over the distribution period, effectively insulating users from extreme market movements. Fewer surprises mean a more reliable income stream.

3. Fairer Distribution for All

One of the most critical aspects of yield ramp-up is its contribution to fairness. In instantaneous models, whales can execute large, short-term moves to capture high yields before they're diluted. With yield ramp-up, the impact of such fleeting opportunities is spread out. A whale's temporary high-yield deposit will only marginally affect the smoothed yield, and their withdrawal won't instantly plummet the APY for others.

4. Reduced Incentive for Short-Term Manipulation

Because yield is smoothed over time, the incentive for short-term "yield hopping" or rapid, manipulative deposits/withdrawals is significantly reduced. This fosters a healthier, more stable environment within the protocol.

5. Enhanced User Confidence

A consistent and predictable return stream builds greater confidence among users. Knowing that APY is less prone to wild swings allows for better financial planning and reduces stress associated with monitoring volatile markets.

Rates are variable and subject to change. Past performance does not guarantee future results.

Yield Ramp-Up in SuperFund

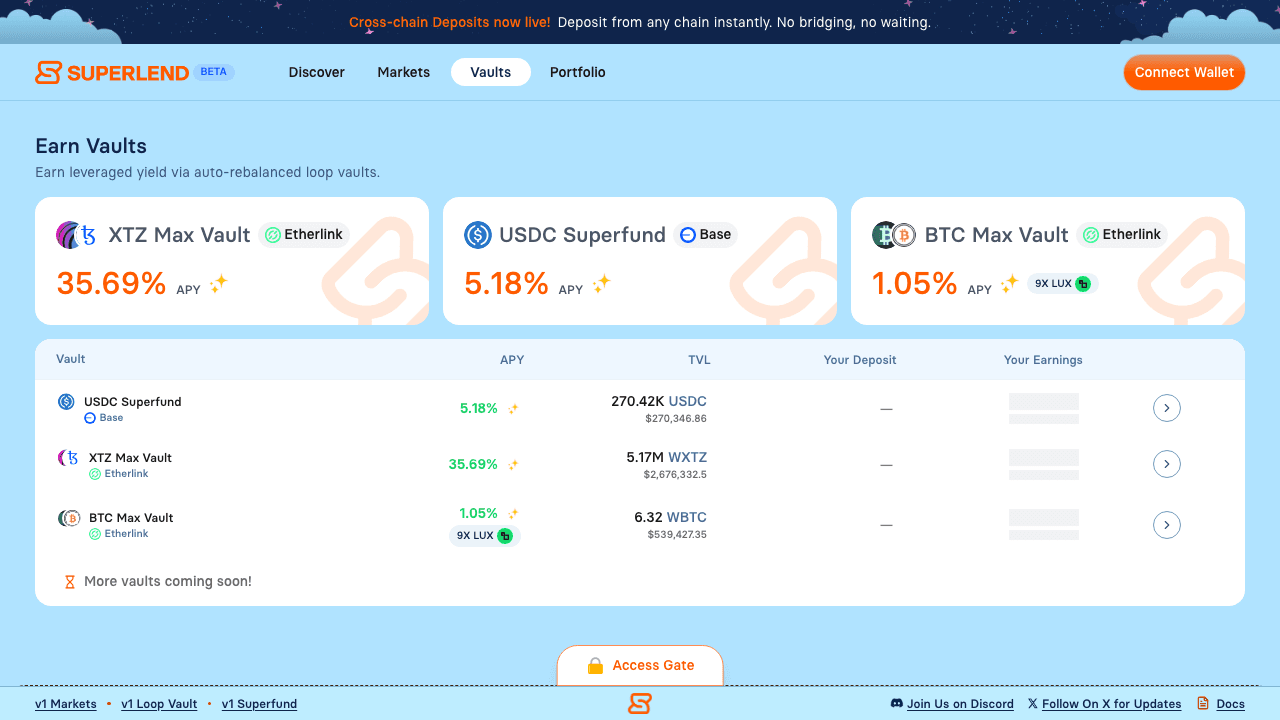

We are implementing Yield Ramp-Up as a yield distribution mechanism on SuperFund, available in the Vaults section on Superlend. We believe it presents a compelling alternative to other models.

By prioritizing a gradual and buffered distribution of earned yield, it creates a smooth, stable return curve that protects users from market volatility and – crucially – fosters a more equitable environment for all depositors.

Why SuperFund with Yield Ramp-Up:

- Smoothed returns over 7-14 day periods

- Protection against whale manipulation

- More predictable income for financial planning

- Automated DeFi yield optimization across protocols

Frequently Asked Questions

What is DeFi yield optimization?

DeFi yield optimization refers to strategies and mechanisms that maximize returns while managing risk and volatility. This includes automated rebalancing across protocols, yield smoothing mechanisms like Ramp-Up, and intelligent capital allocation.

How does Yield Ramp-Up differ from instant yield distribution?

Instant distribution pays out yield immediately as it's earned, exposing users to rate volatility. Yield Ramp-Up buffers earned yield and distributes it gradually over 7-14 days, creating smoother, more predictable returns.

Is Yield Ramp-Up suitable for all DeFi users?

Yield Ramp-Up is ideal for users who prioritize stable, predictable returns over chasing short-term rate spikes. If you're a long-term holder seeking consistent passive income, Yield Ramp-Up provides a better experience than volatile instant-distribution models. For stablecoin-specific strategies, check out our USDC lending guide and stablecoin yield strategies.

Start Optimizing Your DeFi Yield

Ready for stable, predictable DeFi returns? Try SuperFund's Yield Ramp-Up mechanism today.

Launch SuperFund | Browse Superlend Markets | Explore Loop Vaults

This article is for educational purposes only and does not constitute financial advice. DeFi involves risks including smart contract vulnerabilities. Always do your own research.