Arbitrum offers DeFi lending yields ranging from 0.04% on WBTC to over 2.6% APY on stablecoins like USDC, with additional ARB incentives available on select protocols. These rates, combined with transaction costs that are a fraction of Ethereum mainnet, make Arbitrum one of the most attractive destinations for yield-seeking lenders.

This guide covers everything you need to know about lending on Arbitrum: current rates, protocol options, risk factors, and how to maximize your returns using aggregation tools like Superlend, a non-custodial DeFi lending aggregator that helps you find the best yields across multiple protocols.

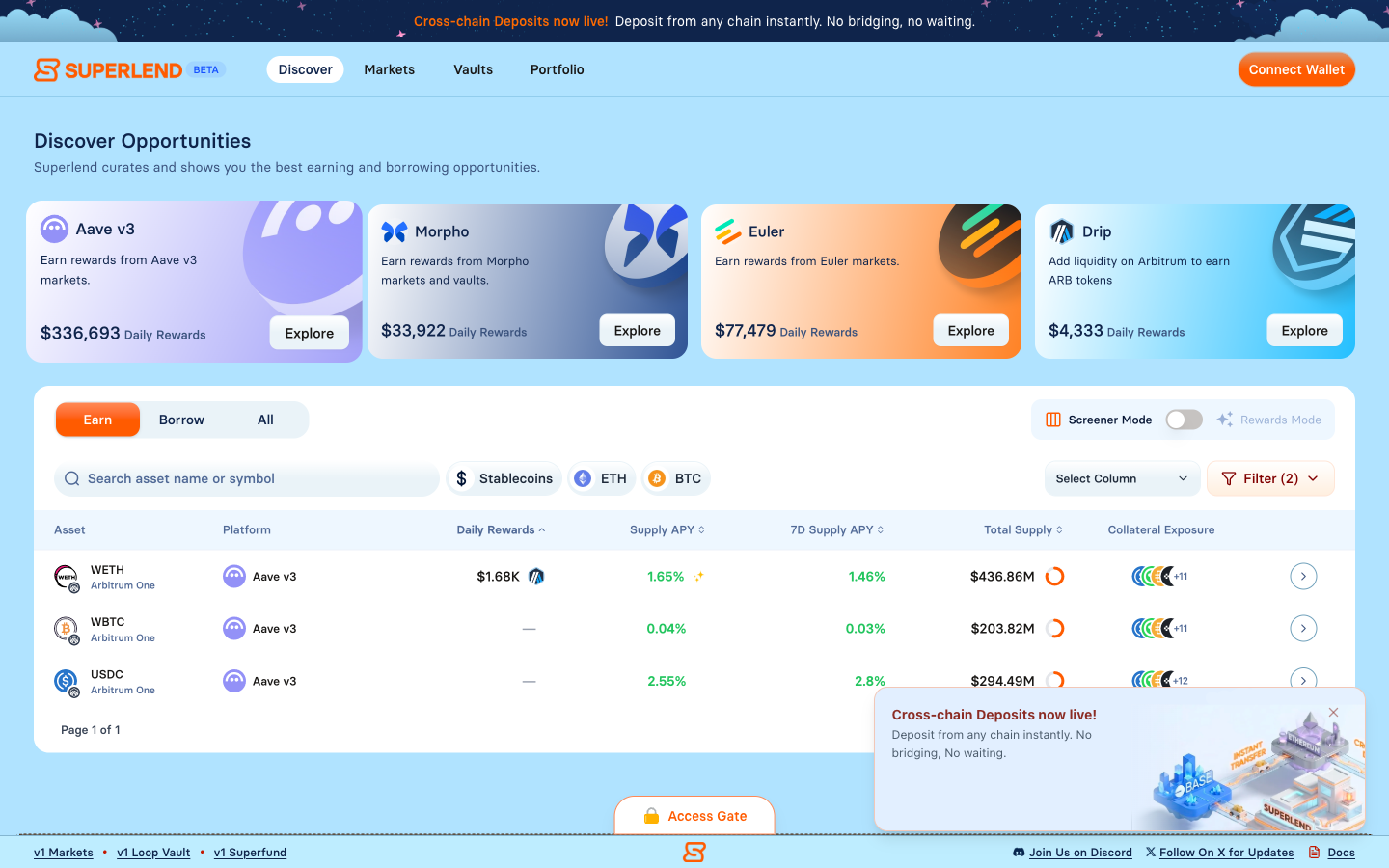

Arbitrum lending opportunities showing current yields across protocols.

Arbitrum lending opportunities showing current yields across protocols.

Why Arbitrum for DeFi Lending?

Arbitrum has established itself as the dominant Layer 2 solution for Ethereum-based DeFi. Several factors make it the preferred choice for lenders seeking better returns than mainnet can offer.

Largest L2 by Total Value Locked

Arbitrum consistently ranks as the largest Layer 2 network by TVL, often exceeding $3 billion in locked assets. This liquidity depth translates directly to more stable lending markets, tighter spreads, and more reliable rate discovery. Deep liquidity pools mean your deposits earn more consistent yields without the rate volatility common on smaller networks.

Transaction Costs That Make Sense

Ethereum mainnet gas fees can easily consume weeks or months of lending yields on smaller positions. A single deposit transaction costing $15-50 in gas makes sub-$10,000 positions economically challenging to manage actively.

Arbitrum transactions typically cost $0.10-0.50, enabling strategies impossible on mainnet:

- Frequent rebalancing between protocols to chase optimal rates

- Smaller position sizes that remain profitable

- Active management of collateral ratios without fee anxiety

Mature Protocol Ecosystem

Unlike newer L2s still building their DeFi infrastructure, Arbitrum hosts battle-tested versions of major lending protocols. Aave v3, Compound, and Radiant all operate on Arbitrum with substantial liquidity. These protocols have years of security track records on mainnet before deploying to Arbitrum, reducing smart contract risk compared to L2-native alternatives.

Current Arbitrum Lending Rates

Understanding current market rates helps you evaluate opportunities and set realistic expectations. These figures represent typical ranges and fluctuate based on utilization and market conditions.

Stablecoin Yields

Stablecoin lending on Arbitrum delivers the most consistent returns:

- USDC: 2.0-3.2% APY depending on protocol and utilization

- USDT: 1.8-2.8% APY with similar variation

- DAI: 2.2-3.0% APY, often slightly higher due to lower liquidity

The 2.6% USDC rate represents a middle-ground expectation. During high borrowing demand, rates can spike significantly higher. For a deeper understanding of how these rates compare to other options, check out our complete guide to DeFi lending.

Major Asset Yields

Blue-chip crypto assets earn lower base yields but benefit from protocol incentives:

- WETH: 1.2-2.0% APY base, with additional protocol rewards pushing effective yields higher

- WBTC: 0.02-0.1% APY base, the lowest among major assets due to limited borrowing demand

The 1.6% WETH and 0.04% WBTC rates reflect current market conditions. ETH lending rates on Arbitrum often track mainnet rates closely, as covered in our ETH lending rates analysis.

Why Rate Variations Exist

Lending rates on Arbitrum vary between protocols for several reasons:

- Utilization rates: Higher borrowing demand pushes supply rates up

- Protocol fee structures: Different protocols take varying cuts

- Incentive programs: ARB rewards effectively boost yields

- Risk parameters: More conservative protocols may offer lower rates but better security

Protocols on Arbitrum

Multiple established protocols compete for depositors on Arbitrum, each with distinct characteristics.

Aave v3

Aave v3 represents the largest lending market on Arbitrum by TVL. Key features include:

- Efficiency mode (E-mode) for correlated asset pairs

- Isolation mode for newer assets with limited exposure

- Cross-chain portal functionality for liquidity movement

- Extensive security audit history

Aave typically offers competitive stablecoin rates and reliable WETH yields. The protocol's conservative risk parameters make it suitable for larger positions prioritizing security over maximum yield.

Compound III (Comet)

Compound's third iteration brought significant architectural changes, including single-asset markets that simplify risk management. On Arbitrum, Compound offers:

- USDC-focused market with competitive rates

- Streamlined collateral model

- Lower gas costs per interaction than Aave

Radiant Capital

Radiant operates as an Arbitrum-native lending protocol with cross-chain ambitions. The protocol offers:

- Higher base rates due to aggressive incentive programs

- RDNT token rewards for depositors and borrowers

- Omnichain functionality across multiple networks

Radiant rates often exceed Aave and Compound but carry additional smart contract risk as a newer protocol.

Silo Finance

Silo takes a unique approach with isolated lending markets, where each asset pair operates independently. This architecture:

- Limits contagion risk between markets

- Enables lending of longer-tail assets

- Provides flexibility for risk-tolerant lenders

ARB Rewards and Incentives

Protocol incentives significantly impact effective yields on Arbitrum. Understanding these programs helps maximize returns.

How ARB Incentives Work

Many protocols distribute ARB tokens to lenders and borrowers as part of Arbitrum Foundation grant programs or protocol-specific initiatives. These rewards add 0.5-3% additional yield depending on:

- Protocol participation in incentive programs

- Your share of total deposits

- Current ARB token price

Maximizing Incentive Capture

To optimize incentive earnings:

- Track active incentive programs across protocols

- Consider protocol-specific tokens (RDNT, etc.) in addition to ARB

- Factor in vesting schedules and claiming costs

- Monitor program duration to avoid chasing expiring incentives

Sustainability Considerations

Incentive-boosted yields attract deposits that may leave when programs end. This creates:

- Rate volatility around program expirations

- Potential impermanent loss on incentive tokens

- Need for active management to maintain optimal positioning

How to Lend on Arbitrum Through Superlend

Superlend simplifies Arbitrum lending by aggregating opportunities across protocols into a single interface. As a non-custodial DeFi lending aggregator, Superlend never takes custody of your funds while helping you find optimal yields.

Step-by-Step Process

1. Connect Your Wallet

Visit Superlend and connect a compatible wallet (MetaMask, WalletConnect, Coinbase Wallet, etc.). Ensure you have ARB network configured, or allow the app to add it automatically.

2. Bridge Assets if Needed

If your assets are on Ethereum mainnet, bridge them to Arbitrum. Native bridges take 7 days for withdrawal, while third-party bridges like Stargate or Hop offer faster options with small fees.

3. Compare Opportunities

Superlend displays lending opportunities across Arbitrum protocols, showing:

- Current APY including base rate and incentives

- Protocol risk ratings

- Liquidity depth and utilization

- Historical rate trends

4. Deposit to Your Chosen Protocol

Select your preferred opportunity and deposit directly through Superlend's interface. The aggregator routes your transaction to the underlying protocol while you maintain full custody of your assets.

5. Monitor and Rebalance

Track your positions through the Superlend dashboard. When better opportunities emerge, rebalance with minimal friction thanks to Arbitrum's low fees.

Arbitrum vs Other L2s

Comparing Arbitrum to alternative L2s helps contextualize its lending advantages.

Arbitrum vs Optimism

Both networks use optimistic rollup technology, but Arbitrum maintains:

- Higher TVL and deeper liquidity

- More lending protocol options

- Slightly lower average transaction costs

Optimism offers competitive rates on protocols like Aave and Sonne but with less protocol diversity.

Arbitrum vs Base

Base has grown rapidly but remains smaller than Arbitrum for lending:

- Fewer established protocols

- Lower overall liquidity depth

- Newer ecosystem with less battle-testing

Base may offer higher incentive rates to attract liquidity, but with correspondingly higher risk.

Arbitrum vs zkSync Era

zkSync uses zero-knowledge proof technology rather than optimistic rollups:

- Faster finality but less mature ecosystem

- Growing lending options but limited TVL

- Higher technical complexity

For lending specifically, Arbitrum's established protocol ecosystem provides advantages over zkSync's developing infrastructure.

Risks and Considerations

DeFi lending on Arbitrum carries risks that every depositor should understand. For comprehensive coverage, read our guide on whether DeFi lending is safe.

Smart Contract Risk

Even audited protocols can contain vulnerabilities. Mitigate this risk by:

- Diversifying across multiple protocols

- Favoring protocols with longer track records

- Monitoring security disclosures and audit updates

Bridge Risk

Assets on Arbitrum depend on bridge security. The canonical Arbitrum bridge has strong security guarantees but:

- 7-day withdrawal delays create liquidity risk

- Third-party bridges introduce additional smart contract exposure

- Bridge exploits on other networks demonstrate the attack surface

Sequencer Centralization

Arbitrum currently relies on a centralized sequencer for transaction ordering. While this introduces trust assumptions:

- Sequencer downtime can prevent position management

- Future decentralization plans are in progress

- The network cannot censor transactions long-term due to forced inclusion

Oracle Risk

Lending protocols depend on price oracles for collateral valuation. Oracle failures can cause:

- Unintended liquidations

- Arbitrage opportunities that drain protocol reserves

- Temporary market dislocations

Liquidity Risk

During market stress, withdrawal liquidity may become constrained:

- High utilization can prevent immediate withdrawals

- Market-wide deleveraging creates cascading effects

- ARB incentive tokens may become illiquid

FAQ

What is the minimum amount needed to start lending on Arbitrum?

Arbitrum's low fees make positions as small as $100 viable for lending. Transaction costs of $0.10-0.50 per operation mean you can deposit, claim rewards, and withdraw without fees consuming significant yield. Compare this to Ethereum mainnet where $5,000+ positions are often needed just to cover gas costs over a reasonable time horizon.

How do I choose between Aave, Compound, and Radiant on Arbitrum?

Consider your priorities: Aave offers the deepest liquidity and most conservative risk parameters, making it suitable for larger positions. Compound's single-asset markets simplify risk management. Radiant provides higher yields through aggressive incentives but carries more smart contract risk as a newer protocol. Using a non-custodial DeFi lending aggregator like Superlend lets you compare current rates across all protocols before committing.

Can I earn yield on both ETH and stablecoins simultaneously on Arbitrum?

Yes, you can maintain lending positions across multiple assets simultaneously. A common strategy involves lending stablecoins for higher base yields while also lending ETH to earn modest returns plus protocol incentives on assets you plan to hold long-term anyway. Just monitor your total exposure and ensure you understand the risks of each position independently.

Conclusion

Arbitrum provides the most mature and liquid environment for DeFi lending on any Layer 2 network. With established protocols like Aave and Compound, transaction costs that enable active management, and ARB incentives that boost effective yields, Arbitrum offers compelling opportunities for yield-seeking depositors.

Current rates of approximately 2.6% on USDC, 1.6% on WETH, and additional incentive rewards represent meaningful returns compared to traditional finance alternatives. The ecosystem's depth and protocol diversity allow for risk-adjusted strategies that balance yield optimization with security considerations.

Using aggregation tools like Superlend simplifies the process of finding optimal yields across Arbitrum's lending landscape. By comparing opportunities in real-time and maintaining full custody of your assets, you can participate in Arbitrum DeFi lending with confidence.

Start exploring Arbitrum lending opportunities today, and leverage the efficiency of Layer 2 technology to maximize your DeFi yields.

This article is for informational purposes only and does not constitute financial advice. DeFi lending involves risks including smart contract vulnerabilities, oracle failures, and potential loss of funds. Always conduct your own research and consider your risk tolerance before depositing assets into any protocol.