"Is DeFi lending safe?" It's a question every newcomer asks – and one that experienced users continue to grapple with. The honest answer is nuanced: DeFi lending carries real risks, but they're risks that can be understood, measured, and managed.

We're not here to tell you DeFi is risk-free. It isn't. We're here to give you the knowledge to make informed decisions about those risks. Because the biggest danger in DeFi isn't any single vulnerability – it's not understanding what you're getting into.

Over the past few years, DeFi lending has matured significantly. Protocols have hardened their security, developed better risk management frameworks, and proven their resilience through multiple market cycles. But that doesn't mean risks have disappeared. They've simply become better understood.

Superlend is a non-custodial aggregator – your funds go directly to underlying protocols like Aave, Compound, and Morpho, not to us. This guide covers smart contract risk, liquidation risk, protocol risk, and practical steps to protect your capital.

Smart Contract Risk

Every DeFi protocol runs on smart contracts – code on a blockchain that handles your funds. Smart contract risk is the possibility that bugs, vulnerabilities, or exploits in this code could lead to loss of funds.

Why This Risk Exists

Smart contracts are immutable once deployed. Unlike traditional software that can be patched quickly, fixing a smart contract vulnerability often requires complex migration processes. And because DeFi protocols handle real money, they're attractive targets for sophisticated attackers who spend months analyzing code for weaknesses.

The history of DeFi includes numerous exploits – flash loan attacks, reentrancy bugs, oracle manipulation, and logic errors that have collectively cost users billions of dollars. These aren't theoretical risks; they're documented incidents that have affected both small protocols and large ones.

How to Evaluate Smart Contract Risk

Not all protocols carry the same smart contract risk. Here's what to look for:

Security Audits: Has the protocol been audited by reputable firms? Multiple audits from different firms provide more confidence than a single review. Look for audits from well-known security firms, and check that audits cover the current version of the contracts, not just earlier versions.

Time in Market: How long has the protocol been live with significant value locked? Code that has held hundreds of millions of dollars for years without incident has been battle-tested in ways that audits alone can't replicate. This doesn't guarantee safety, but it's meaningful evidence.

Total Value Locked (TVL): Higher TVL means the protocol is a bigger target, but it also means more eyes are watching it. Major protocols with billions in TVL have significant resources dedicated to security and attract white-hat hackers who report vulnerabilities for bounties rather than exploiting them.

Bug Bounty Programs: Does the protocol offer substantial rewards for discovering vulnerabilities? Active bug bounty programs incentivize security researchers to find and report bugs rather than exploit them.

Mitigation Strategies

- Focus on established protocols with long track records

- Diversify across multiple protocols rather than concentrating in one

- Start with smaller amounts and increase over time as you build confidence

- Monitor protocol security updates and news

Protocol Risk

Beyond the code itself, there are risks related to how a protocol is governed and operated. Protocol risk encompasses governance attacks, economic exploits, and administrative vulnerabilities.

Governance Attacks

Many DeFi protocols are governed by token holders who can vote to change parameters, upgrade contracts, or control treasury funds. If an attacker accumulates enough governance tokens, they could potentially push through malicious proposals. While most major protocols have time-locks and other safeguards, governance attacks remain a theoretical concern.

Economic Exploits

Some attacks don't exploit bugs in the code – they exploit flaws in the economic design. Flash loan attacks, for instance, allow attackers to borrow massive amounts without collateral for a single transaction, potentially manipulating prices or draining funds through complex sequences of operations.

Oracle Manipulation

DeFi protocols rely on oracles – external data feeds that provide price information. If an attacker can manipulate oracle prices, they might be able to borrow more than their collateral should allow, or trigger inappropriate liquidations. Established protocols use decentralized oracle networks and multiple data sources to prevent this, but oracle risk remains a consideration.

How Established Protocols Protect Against These

Major lending protocols like Aave, Compound, and Morpho have implemented multiple layers of protection:

- Governance time-locks that delay execution of proposals

- Guardian multisigs that can pause the protocol in emergencies

- Decentralized oracle networks with multiple data sources

- Economic simulations and stress testing

- Gradual parameter changes rather than sudden shifts

Liquidation Risk

Liquidation risk applies specifically to borrowers. If you're only supplying assets to earn yield without borrowing against them, you can skip this section. But if you're borrowing, this is critical to understand.

What Triggers Liquidation

When you borrow in DeFi, you must provide collateral worth more than what you borrow – this is called overcollateralization. If the value of your collateral drops (or the value of what you borrowed rises), your position becomes undercollateralized and can be liquidated.

During liquidation, the protocol allows anyone to repay part of your debt in exchange for your collateral at a discount. This protects the protocol from bad debt but results in losses for you – typically 5-15% of the liquidated amount.

Understanding Health Factors

Most lending protocols display a "health factor" for your position. This number indicates how safe your position is from liquidation:

- Health factor > 2: Relatively safe, significant buffer

- Health factor 1.5-2: Moderate risk, monitor closely

- Health factor 1.0-1.5: High risk, consider adding collateral

- Health factor < 1.0: Liquidation can occur

How to Avoid Liquidation

- Maintain a conservative health factor (2.0 or higher)

- Monitor your positions regularly, especially during volatile markets

- Set up alerts for when your health factor drops below thresholds

- Have capital ready to add collateral if needed

- Use stablecoins as collateral when possible to reduce volatility exposure

- Avoid maximum borrowing – just because you can borrow 75% of your collateral value doesn't mean you should

Stablecoin Risk

If you're lending stablecoins – and most DeFi lending involves stablecoins – you need to understand that not all stablecoins are created equal.

Depeg Events

Stablecoins are designed to maintain a 1:1 peg with the US dollar, but this peg can break. When a stablecoin "depegs," it trades below (or occasionally above) its intended value. Depeg events have occurred with various stablecoins, sometimes temporarily and sometimes permanently.

Different types of stablecoins have different risk profiles:

Fiat-backed stablecoins (USDC, USDT) are backed by reserves held by centralized entities. Their main risks are custodial – you're trusting the issuer to maintain adequate reserves and remain solvent. USDC briefly depegged in 2023 due to exposure to a failed bank, though it recovered. For strategies on lending USDC specifically, see our USDC lending guide.

Crypto-backed stablecoins (DAI) are overcollateralized by crypto assets. They're more decentralized but can be affected by extreme market volatility that impacts their collateral.

Algorithmic stablecoins use various mechanisms to maintain their peg without full backing. These have historically been the riskiest category, with some failing entirely.

Diversification Approach

Consider spreading your stablecoin exposure across different types and issuers. If you're lending $100,000 in stables, holding it all in a single stablecoin concentrates your risk. Splitting across USDC, USDT, and DAI provides some protection against any single stablecoin having problems. For more on optimizing stablecoin yields, see our stablecoin yield strategies guide.

Market Risk

Market risk refers to the impact of price movements and broader market conditions on your DeFi lending positions.

Volatile Asset Exposure

If you're lending volatile assets like ETH or BTC rather than stablecoins, you're exposed to price movements in those assets. A 50% drop in ETH price means a 50% drop in the dollar value of your lending position, regardless of the yield you're earning. For current rates on these assets, see our guides on ETH lending rates and wBTC lending.

Rate Volatility

DeFi lending rates are not fixed – they fluctuate based on supply and demand. The 8% APY you see today might be 3% next week if market conditions change. Don't make financial plans based on current rates persisting indefinitely.

Timing Considerations

Market conditions affect DeFi yields significantly. During bull markets, borrowing demand increases as traders leverage up, which typically raises lending rates. During bear markets, demand contracts and rates often fall. Understanding these cycles can help set realistic expectations.

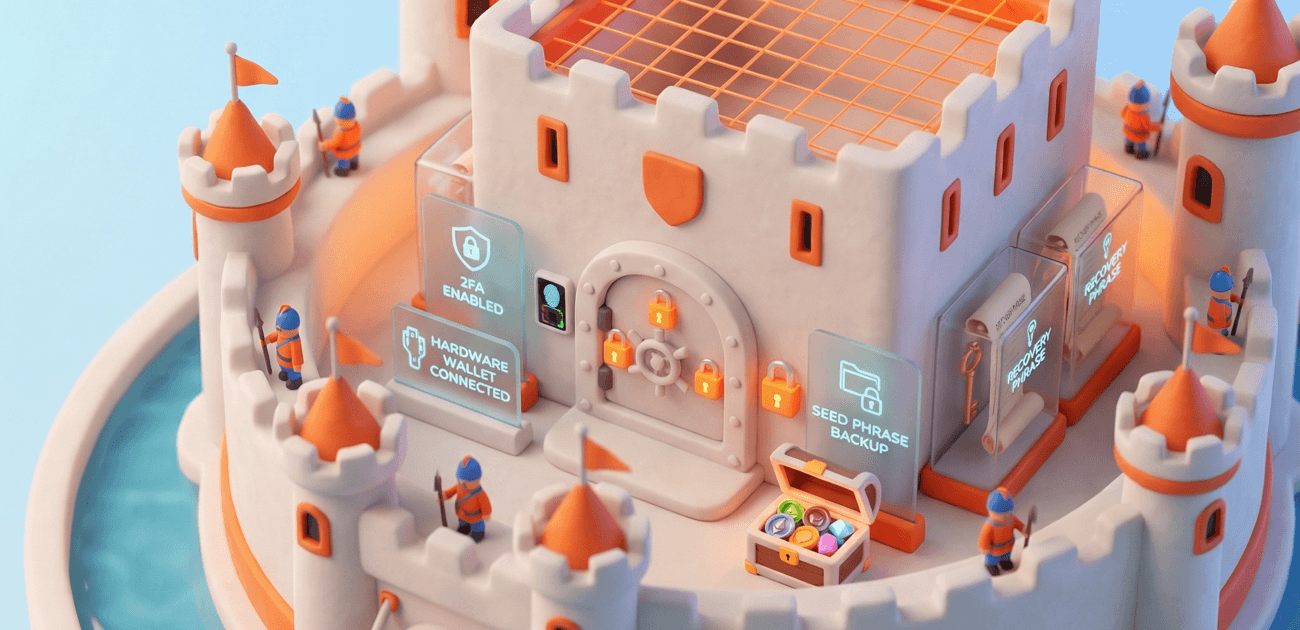

How to Minimize Risk

Now that you understand the risks, here's how to manage them practically.

Use Established Protocols

Stick to protocols that have proven themselves over time. Aave, Compound, and Morpho have billions in TVL, years of operation, multiple audits, and have survived various market conditions. Newer protocols might offer higher rates, but they carry more unknown risks.

Diversify Across Protocols

Don't put all your funds in a single protocol. If you're lending $50,000, spreading it across three or four protocols means a catastrophic failure in one doesn't wipe you out entirely. Yes, this is more work to manage, but it's meaningful risk reduction.

Start Small

If you're new to DeFi lending – or new to a particular protocol – start with amounts you can afford to lose entirely. Increase your exposure as you build understanding and confidence. There's no rush.

Understand What You're Doing

This sounds obvious, but it's crucial. Don't deposit funds into a protocol you don't understand. Read the documentation. Understand the risks. Know what assets you're exposed to and what could go wrong. Confusion is a risk factor.

Monitor Your Positions

DeFi isn't "set and forget." Check your positions regularly. Monitor for news about protocols you're using. Set up alerts for significant events. The few minutes this takes weekly can save you from preventable losses.

What Makes a Protocol Safer

When evaluating a lending protocol's safety, consider these factors:

Multiple Independent Audits

The best protocols have been audited by multiple reputable security firms at different points in their development. Look for recent audits that cover current contracts, not just audits of earlier versions. Check whether critical or high-severity issues were found and how they were addressed.

Significant TVL and Track Record

Protocols that have held billions of dollars for years without major incidents have demonstrated real-world security. TVL alone isn't a guarantee – but time in market with significant funds is meaningful evidence. A protocol that's been live for three years with $2 billion in TVL has been stress-tested in ways that newer protocols haven't.

Active Development and Responsiveness

How does the team respond to issues? Do they push regular updates? Do they have a track record of addressing vulnerabilities quickly? Active development and transparent communication about security matters.

Insurance Options

Some protocols offer or integrate with DeFi insurance providers. While insurance doesn't prevent losses, it can provide a backstop. Coverage availability from third-party insurers also signals that professional risk assessors consider the protocol insurable.

Transparent Risk Parameters

Good protocols are transparent about their risk parameters – collateral factors, liquidation thresholds, supported assets, and how parameters are set and changed. If you can't find clear documentation about how risk is managed, that's a red flag.

How Superlend Helps

Superlend doesn't eliminate DeFi risks – no one can. But we can help you navigate them more effectively.

When you use Superlend, you're accessing established protocols like Aave, Compound, Morpho, and others through a single interface. We aggregate rates and opportunities across 350+ money markets on 11+ chains, but the actual lending happens on these battle-tested protocols.

Importantly, Superlend never takes custody of your funds. You connect your wallet, and your assets go directly to the underlying protocols. We're an interface and aggregator – your funds are secured by the protocols themselves, not by us.

Our comparison tools help you evaluate options side by side, seeing not just rates but also protocol TVL, utilization, and other factors that affect risk. You can make more informed decisions about where to deploy your capital.

Ready to explore your options? Start comparing rates on Superlend.

Frequently Asked Questions

Can I lose all my money in DeFi lending?

Yes, it's possible. Smart contract exploits, protocol failures, or stablecoin collapses could result in total loss of deposited funds. This is why diversification and using established protocols matters. The probability of losing everything across multiple established protocols simultaneously is much lower than the risk with a single protocol or a new, unproven one.

Is DeFi lending safer than traditional crypto investing?

It depends on what you're comparing. Lending stablecoins on established protocols has different (and arguably lower) volatility risk than holding volatile cryptocurrencies. However, it introduces smart contract and protocol risks that don't exist with simply holding assets in a hardware wallet. There's no single "safer" option – just different risk profiles.

How much should I put into DeFi lending?

Only invest what you can afford to lose entirely. DeFi is still relatively new technology, and despite maturation, risks remain. Many experienced users suggest keeping DeFi exposure to a portion of your overall portfolio – not your entire savings. Start small and increase only as you build understanding and comfort.

Are higher yields always riskier?

Generally, yes. In efficient markets, higher returns compensate for higher risks. If a protocol offers significantly higher rates than established competitors, ask why. It could be token incentives (which have their own risks), lower security standards, riskier collateral types, or other factors. Unusually high yields should trigger skepticism, not excitement.

Conclusion

DeFi lending isn't safe in the way a bank savings account is safe. It carries real risks – smart contract vulnerabilities, protocol failures, liquidation dangers, stablecoin instability, and market volatility. These risks have materialized in the past and will materialize again in the future.

But DeFi lending also isn't the Wild West it was a few years ago. Major protocols have matured, security practices have improved, and the ecosystem has learned from past failures. The risks are increasingly well-understood, and they can be managed through careful protocol selection, diversification, and proper risk awareness.

The key is education. Understanding what can go wrong empowers you to make informed decisions about whether the potential returns justify the risks – and how to minimize those risks when you do participate.

If you choose to lend in DeFi, do it with eyes open. Use established protocols. Diversify your exposure. Start small. Monitor your positions. And never risk more than you can afford to lose.

Further Reading:

This article is for educational purposes only and does not constitute financial advice. DeFi lending involves significant risks including smart contract vulnerabilities, protocol failures, liquidation risk, and potential loss of funds. Past performance does not guarantee future results. Rates are variable and subject to change. Always conduct your own research before making investment decisions, and never invest more than you can afford to lose.