Yield farming is the practice of earning returns on your cryptocurrency by putting it to work in decentralized finance (DeFi) protocols. Depending on the strategy and asset, you can expect annual yields ranging from 1-2% on volatile assets like ETH to 3-9% or higher on stablecoins.

If you've been curious about how people earn passive income with crypto beyond just holding and hoping for price increases, yield farming is one of the most popular methods. This guide breaks down what yield farming actually is, the different types available, and how to get started as a complete beginner.

What is Yield Farming?

Yield farming refers to any strategy where you deposit cryptocurrency into a DeFi protocol to earn rewards. The term "farming" comes from the idea that you're cultivating or growing your crypto holdings over time, similar to how a farmer grows crops.

Yield farming works because DeFi protocols need liquidity to function. Lending protocols need deposits to lend out. Decentralized exchanges need liquidity for traders to swap tokens. Protocols incentivize users to provide this liquidity by sharing fees or distributing token rewards.

When you participate in yield farming, you're essentially providing a service to the protocol –whether that's lending your assets, providing trading liquidity, or staking tokens to secure a network. In return, you receive compensation in the form of interest, fees, or additional tokens.

The yields in DeFi often exceed traditional finance because:

- There are no intermediary banks taking a cut

- Protocols compete for deposits by offering attractive rates

- Smart contracts automate operations, reducing overhead costs

- Some protocols distribute governance tokens as additional incentives

If you're new to decentralized finance altogether, you might want to read our introduction to DeFi before diving into yield farming strategies.

Types of Yield Farming Strategies

Yield farming isn't a single activity – it encompasses several different yield farming strategies, each with its own risk-reward profile.

Lending

The most straightforward form of yield farming is lending your crypto through a DeFi protocol. You deposit assets like USDC, ETH, or other tokens into a lending pool. Borrowers pay interest to access these funds, and that interest gets distributed to lenders.

Lending is considered the most beginner-friendly crypto yield farming strategy because you maintain exposure to a single asset. If you deposit USDC, you get back USDC plus interest. There's no complex token mechanics to understand.

Popular lending protocols include Aave, Compound, and Morpho. Each offers different rates and operates on various blockchains. Comparing rates across protocols manually can be tedious, which is why aggregators exist to simplify the process.

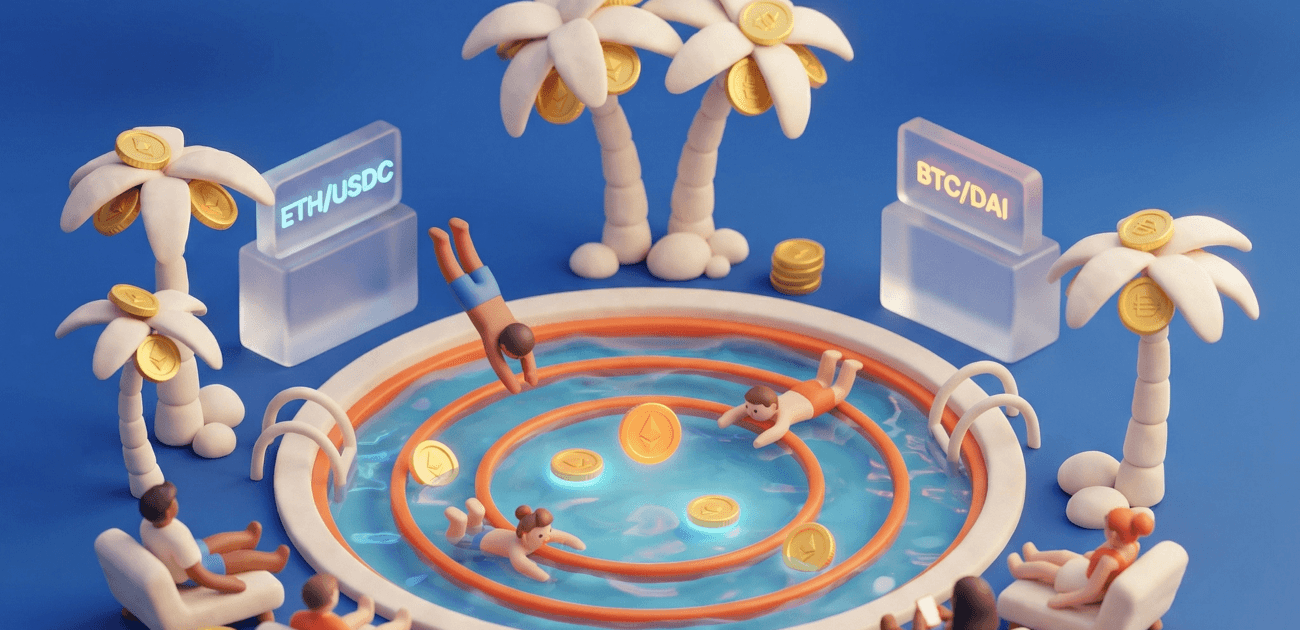

Liquidity Provision

Liquidity provision involves depositing pairs of tokens into a decentralized exchange (DEX) like Uniswap or Curve. You're enabling traders to swap between those tokens, and in return, you earn a share of the trading fees.

For example, if you provide liquidity to an ETH/USDC pool, traders swapping between ETH and USDC pay a small fee that gets distributed to liquidity providers like you.

The catch is that liquidity provision exposes you to something called impermanent loss –if the relative prices of your deposited tokens change significantly, you may end up with less value than if you had simply held the tokens separately. We'll cover this risk in more detail below.

Staking

Staking involves locking up tokens to help secure a blockchain network or participate in protocol governance. Proof-of-stake networks like Ethereum reward stakers with newly issued tokens for helping validate transactions.

Staking yields tend to be more predictable than other forms of yield farming since they're tied to network inflation schedules rather than market demand. However, staked tokens are often locked for a period, limiting your flexibility.

Liquid staking protocols like Lido allow you to stake while receiving a liquid token in return, which you can then use in other DeFi activities –effectively compounding your yield farming strategies.

Yield Aggregators and Vaults

Yield aggregators are protocols that automatically move your funds between different yield opportunities to maximize returns. Instead of manually monitoring and switching between protocols, you deposit into a vault that handles optimization for you.

These vaults often employ complex strategies –like auto-compounding rewards, shifting between lending protocols based on rates, or combining multiple yield sources. The tradeoff is an additional layer of smart contract risk and management fees.

How DeFi Lending Works

Since lending is the simplest entry point for yield farming beginners, let's walk through exactly how it works.

When you deposit assets into a lending protocol, your funds enter a shared lending pool. Borrowers can take loans from this pool by providing collateral –typically 150% or more of their loan value in other crypto assets.

The interest rate you earn is determined by supply and demand. When borrowing demand is high relative to available deposits, rates increase to attract more lenders. When there's excess liquidity, rates decrease.

Here's a practical example: You deposit 1,000 USDC into Aave on the Base network. The current supply APY is 5%. After one year, assuming rates stay constant, your deposit grows to approximately 1,050 USDC. You can withdraw your funds at any time –there's no lock-up period on most lending protocols.

Your deposited funds are represented by "supply tokens" or "aTokens" in Aave's case. These tokens automatically accrue interest and can be redeemed for your underlying deposit plus earnings at any time.

For a deeper dive into how lending protocols work, check out our complete guide to DeFi lending.

Current Yield Farming Rates

Yield farming rates fluctuate constantly based on market conditions, but here are typical ranges you can expect:

Stablecoins (USDC, USDT, DAI): 3-9% APY through lending protocols. Stablecoin yields are popular because you earn returns without exposure to crypto price volatility. During high-demand periods, rates can spike above 10%. Our stablecoin yield strategies guide covers the best opportunities in detail.

ETH and Liquid Staking Tokens: 1-2% base staking yield, with potential for additional returns through lending or liquidity provision. Native ETH staking currently offers around 3-4% APY, while lending deposited ETH typically yields 1-2%.

Bitcoin (WBTC, cbBTC): 0.5-3% through lending protocols. Bitcoin yield opportunities in DeFi are more limited compared to ETH or stablecoins.

Governance and Smaller Tokens: Rates vary wildly –from near zero to double-digit percentages. Higher yields often come with higher risks and lower liquidity.

These rates are base yields from major protocols. Some yield farming strategies layer multiple sources –like earning lending interest plus protocol token rewards –to achieve higher total returns. However, additional yield sources often mean additional risks.

To compare current rates across lending protocols, you can use Superlend's discover page, which aggregates yields from multiple protocols and chains in real-time.

Superlend's Discover page showing yield farming opportunities across protocols.

Superlend's Discover page showing yield farming opportunities across protocols.

Getting Started with Yield Farming

Ready to try yield farming? Here's a step-by-step approach for beginners:

Step 1: Set Up a Wallet

You'll need a non-custodial wallet like MetaMask, Rabby, or Coinbase Wallet. These wallets let you interact directly with DeFi protocols while you maintain full control of your assets.

Step 2: Get Some Crypto

Transfer funds to your wallet. If you're starting with yield farming, stablecoins like USDC are a good choice since you can focus on earning yield without worrying about price movements.

You'll also need a small amount of the native token for the blockchain you're using (ETH for Ethereum, ETH for Base, etc.) to pay transaction fees.

Step 3: Choose Your Strategy

For beginners, lending stablecoins is the lowest-complexity starting point. You deposit one asset, earn interest in that same asset, and can withdraw anytime.

Step 4: Compare Rates and Select a Protocol

This is where a DeFi lending aggregator becomes valuable. Superlend is a non-custodial DeFi lending aggregator that lets you compare lending rates across multiple protocols and chains from a single interface. Instead of checking Aave, Compound, and Morpho separately, you see all opportunities ranked by yield.

For the easiest possible entry point, consider SuperFund vaults. These automated vaults handle protocol selection and optimization for you –just deposit your stablecoins and the vault allocates funds to maximize yields while managing risk.

Step 5: Deposit and Monitor

Connect your wallet to your chosen protocol or aggregator, approve the token for spending, and deposit. Your funds immediately start earning yield.

Check back periodically to monitor your earnings and ensure rates remain competitive. If better opportunities emerge elsewhere, you can withdraw and redeploy –though factor in transaction costs before moving small amounts.

Risks of Yield Farming

Every yield farming strategy carries risks. Understanding these risks helps you make informed decisions and avoid costly mistakes.

Smart Contract Risk

DeFi protocols are built on smart contracts –code that automatically executes transactions. If there's a bug or vulnerability in this code, attackers could potentially drain funds from the protocol.

Major protocols like Aave and Compound have been audited multiple times and battle-tested over years with billions of dollars, reducing (but not eliminating) smart contract risk. Newer or less established protocols carry higher risk.

You can mitigate smart contract risk by sticking to established protocols, diversifying across multiple platforms, and avoiding strategies you don't fully understand.

Impermanent Loss (For Liquidity Providers)

If you provide liquidity to a DEX, you're exposed to impermanent loss. This occurs when the prices of your deposited tokens change relative to each other.

For example, if you deposit equal values of ETH and USDC into a liquidity pool and ETH's price doubles, the pool mechanics mean you'll end up with more USDC and less ETH than you started with. The total value of your position will be less than if you had simply held both tokens separately.

Impermanent loss can be offset by trading fees earned, but in volatile markets, the loss can exceed fee earnings. This risk doesn't apply to single-asset strategies like lending.

Rate Volatility

DeFi yields are variable, not fixed. The 8% APY you see today might be 2% next week if market conditions change. Building projections around current rates can lead to disappointment.

Rate volatility is driven by supply and demand dynamics. During market downturns, borrowing demand often decreases, pushing lending rates lower. During bull markets, rates tend to increase as more people want to borrow against their appreciating assets.

Liquidation Risk (For Borrowers)

If you're borrowing as part of a leveraged yield farming strategy, you face liquidation risk. Should your collateral value drop below the protocol's threshold, your position can be automatically liquidated, resulting in losses.

This risk doesn't apply to simple lending strategies where you're only depositing, not borrowing.

Protocol and Governance Risk

Even if smart contracts are secure, protocol governance decisions could negatively affect depositors. Changes to interest rate models, fee structures, or supported assets can impact your returns.

For a more detailed breakdown of DeFi risks and how to evaluate them, read our guide on whether DeFi lending is safe.

Yield Farming vs Traditional Savings

How does yield farming compare to keeping your money in a traditional savings account?

Returns: High-yield savings accounts currently offer 4-5% APY. Stablecoin yield farming can match or exceed this, with rates typically ranging 3-9% depending on market conditions and protocol choice.

Risk Profile: Bank deposits are FDIC insured up to $250,000 in the US. DeFi deposits have no government insurance –if something goes wrong, there's no guarantee of recovery. However, major DeFi protocols have operated securely for years with billions in deposits.

Access and Control: Bank accounts require identity verification and can restrict access. DeFi is permissionless –anyone with a wallet can participate, and you maintain custody of your assets.

Flexibility: Most DeFi lending has no lock-up periods. You can deposit and withdraw freely. Some savings accounts have similar flexibility, while CDs lock your money for fixed terms.

Complexity: Opening a savings account is straightforward. Yield farming requires understanding wallets, transactions, and protocol mechanics –a steeper learning curve but more control over your money.

The right choice depends on your risk tolerance, technical comfort level, and how much of your savings you're willing to expose to smart contract risk.

FAQ

What is the minimum amount needed to start yield farming?

There's no minimum to interact with most DeFi protocols –you could theoretically deposit $10. However, transaction fees make small deposits impractical on some networks. On Ethereum mainnet, gas fees might cost $5-50 per transaction. Layer 2 networks like Base, Arbitrum, or Optimism have fees under $1, making them suitable for smaller amounts. A reasonable starting point is $100-500 to ensure fees don't eat into your yields.

Can you lose money yield farming?

Yes. While simple lending strategies return your original deposit plus interest, several scenarios can result in losses: smart contract exploits could drain protocol funds, stablecoin depegging could reduce your deposit's value, and liquidity provision can result in impermanent loss during volatile markets. The assets themselves could also lose value –if you're farming yield on ETH and ETH's price drops 50%, your total portfolio value drops even if your ETH balance increased.

How are yield farming returns taxed?

Tax treatment varies by jurisdiction, but in most countries, yield farming returns are taxable income. Interest earned from lending is typically treated as ordinary income. Token rewards may be taxed at fair market value when received. Swapping tokens or providing liquidity can trigger capital gains events. Keep detailed records of your transactions and consult a tax professional familiar with cryptocurrency.

Conclusion

Yield farming offers crypto holders a way to generate returns on assets that would otherwise sit idle. From simple lending to complex liquidity strategies, there's a spectrum of opportunities with varying risk-reward profiles.

For beginners, starting with stablecoin lending through established protocols provides a low-complexity entry point. You can earn competitive yields without exposure to crypto price volatility or the complexities of liquidity provision.

As you gain experience, you might explore additional strategies –liquid staking, yield aggregators, or carefully managed liquidity positions. The key is understanding the risks involved with each strategy before committing significant funds.

Tools like Superlend simplify the process by aggregating opportunities across protocols and chains, letting you find the best yields without manually checking dozens of platforms. Whether you use an aggregator or interact with protocols directly, yield farming puts your crypto to work in the growing DeFi economy.

This article is for informational purposes only and does not constitute financial advice. DeFi yield farming involves significant risks including smart contract vulnerabilities and potential loss of funds. Always conduct your own research and consider your risk tolerance before participating.